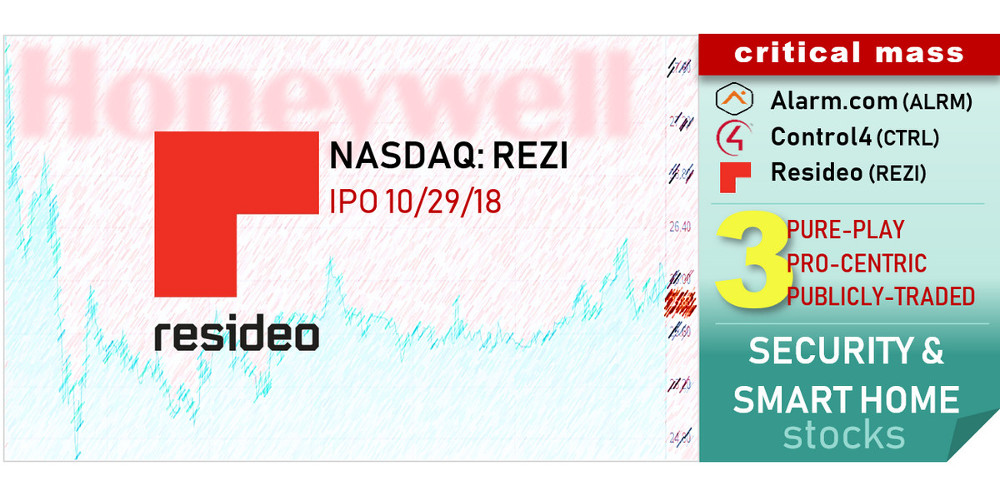

How Does Honeywell’s Resideo Stock Compare to Alarm.com, Control4?

Honeywell spinoff Resideo joins Control4 and Alarm.com as the only pure-play, pro-centric security and smart home stocks. Here’s how it compares to 12 publicly traded competitors.

Alarm.com (ALRM) and Control4 (CTRL) used to be the only pure-play, pro-centric security and home automation companies on the U.S. stock market. Now comes a third publicly traded competitor, Resideo (NYSE: REZI), the Honeywell spinoff that went public on Monday, Oct. 29.

A trio probably qualifies as a critical mass of companies dedicated to professionally installed and monitored smart home and security systems. With the onslaught of DIY systems that were “so easy your grandmother could do it,” the home-tech “channel” was supposedly dead when Control4 launched a successful IPO in 2013.

Alarm.com, the SHaaS (smart home as a service) provider whose dealers charge $25 to $75 per month for monitored security and remote smart home management, was a dinosaur: “Everyone monitors their own systems for free,” they all said when Alarm.com went public in 2015.

Investors rewarded both companies then, and continue to do so today — not without some dips along the way.

Resideo didn’t fare quite as well as Control4 and Alarm.com on REZI’s first day of trading Monday, but at least the home-technology industry will for the first time have a good gauge of market sentiment with a trio of like-minded public companies.

From an opening price of $28, REZI hit the market Monday at $27.85 and ended the IPO day at $25.83, down $2.03 or $7.29%, with some 30.4 million shares traded.

The stock fell further after hours to $25.05, on volume of 11.5 million.

REZI vs. CTRL vs. ALRM

Was it just a bad day for the stock market in general? Technology stocks? Pure-play home automation stocks?

Not really. True, most major indicators were down on Monday, but not by 7.3% (to be sure, an unfair comparison for an IPO stock).

Control4 dropped 0.76% Monday. Alarm.com fell 1.78%.

Both competitors are very similar to Resideo, offering residential security and home automation products and services primarily to professional installers, and in some cases the DIY sector.

All three companies — now that Resideo has split from the diversified Honeywell — are mainly focused on the residential/consumer sector, with little focus on, or penetration in, the commercial/industrial sectors.

Performance of all three stocks in aggregate will indicate Wall Street’s sentiment towards professionally installed, integrated, monitored and supported home-technology systems.

Take a look below at how Monday looked for smart home and related U.S. stocks, as well as the stock market in general.

Comparing Public Security, Smart Home, CE Companies

Closest REZI equivalents – security and smart home products and services, sold primarily through professional installers and service providers

Resideo (Nasdaq: REZI) -7.3% Monday

- Channels – primarily high-volume security and smart home dealers and installers, with some DIY, but always with an eye towards selling professional monitoring

- Some light-commercial business as well

- Hardware: security, home automation and related hardware

- Services: professional alarm monitoring services, cellular networks

- Platform: Total Connect SHaaS (smart home as a service), integrating home automation and professionally monitored security systems – competitive with Alarm.com

- Also includes ADI, the massive distributor of residential and commercial security, A/V, networking, controls, and all manner of low-voltage gear.

- IPO 10/29/18 – Down 7.3% on IPO day

Alarm.com (Nasdaq: ALRM) -1.78% Monday

- Channels – almost exclusively high-volume security and smart home dealers, with some (reluctant) DIY play since it inherited Icontrol’s Piper unit

- Starting to enter various commercial sectors

- Platform: focus on SHaaS platform, competitive with Resideo

- Hardware: growing security and smart home hardware business

- IPO 6/26/2015 – Up 5% on IPO day

Control4 (Nasdaq: CTRL) -0.76 Monday

- Channels – mid-market to high-end home-technology integrators and specialty A/V shops, with zero direct-to-consumer sales

- Hardware: mainstream and higher-end home automation, audio, video, lighting controls, access controls, networking (Pakedge) and related gear

- Platforms: Ihiji for remote network monitoring and diagnostics (primarily for service providers); 4Sight for remote smart home access and configuration (end-user tool)

- Does not sell traditional alarm systems, but integrates with third-party systems

- IPO 8/5/2013 – Up 7.8% on IPO day

Strong REZI competitors in pro-centric security and home-automation, but contributions diluted by corporation’s other interests

- ADT (NYSE: ADT) – Corp. focus on pro-oriented security (including cyber) and building controls, with strong business in residential security/smart home installation, monitoring, and SHaaS via Alarm.com: -1.62% Monday

- Napco (Nasdaq: NSSC) – Corp. focus on pro-oriented security and building controls, with strong business in residential security and home automation hardware, along with iBridge SHaaS platform: +0.44% Monday

- United Technologies Corp. (NYSE: UTX) – Interlogix brand is one of REZI’s top competitors, with a strong portfolio of security and home automation offerings including its own SHaaS; however, it’s just a blip in the UTX financials: -1.74% Monday

- Johnson Controls (NYSE: JCI) – Building/industrial-controls giant picked up two strong REZI competitors, Qolsys and DSC, when it acquired Tyco in 2016, but like Interlogix the brands shrink under the conglomerate umbrella: -0.13% Monday

Related to REZI – smart home solutions catering to DIY, but with a strong following among custom installation pros

- Sonos (Nasdaq: SONO) – Whole-house music systems that integrate with home-automation systems, and are gathering built-in intelligence of their own; ostensibly sold through DIY channels, but also very popular among professional home-technology integrators. -0.41%Monday

- Logitech (Nasdaq: LOGI) – Lots of DIY computer peripherals and some commercial-oriented solutions, including video collaboration. Strong smart-home portfolio including home-automation hubs and remote controls under the Harmony brand, often sold and installed by professional integrators. +0.023% Monday

- Arlo Technologies (NYSE: ARLO) – Recently spun out of Netgear, and formerly “just a smart camera company,” Arlo is growing its smart-home portfolio, starting with a video doorbell and security light. +3.15% Monday

Other REZI-related

- Ascent Capital Group (Nasdaq: ASCMA), owner of Brinks Home Security (formerly MONI and Monitronics) – Primarily a central monitoring station and dealer program for mass-market security and smart-home pros. DIY unit (formerly LiveWatch) provides third-party security and automation systems (Qolsys hardware, Alarm.com SHaaS) for self-installation and professional monitoring. -7.52% Monday

- Universal Electronics Inc. (Nasdaq: UEIC) – OEM remote-control provider for most major A/V-device brands, with back-end services for device discovery, voice control and smart-home integration; building home-automation portfolio with acquisition of Ecolink (security devices) and RCS (smart thermostats and energy management). -2.10% Monday

Stock-Market Indices on REZI IPO Day

- Dow Jones Industrial Average: -0.99%

- S&P 500: -0.29%

- Nasdaq 100 Technology Sector: -1.39%

- Dow Jones US Consumer Electronics Index: -2.34%

Editor’s Note: This story first ran in Security Sales and Integration’s sister publication CE Pro.

If you enjoyed this article and want to receive more valuable industry content like this, click here to sign up for our FREE digital newsletters!

Security Is Our Business, Too

For professionals who recommend, buy and install all types of electronic security equipment, a free subscription to Commercial Integrator + Security Sales & Integration is like having a consultant on call. You’ll find an ideal balance of technology and business coverage, with installation tips and techniques for products and updates on how to add to your bottom line.

A FREE subscription to the top resource for security and integration industry will prove to be invaluable.

As a Control4 dealer in London, I hope that Control4 continues to grow. We need variation in this industry otherwise it will be Amazon Vs Google. Compared to amazon or google, companies like Control4 has a great training and support system. Customers are benefited by such system. I don’t think Amazon or Google will be able to offer quality customer support. all their customer supports have already been shipped to foreign locations.

Let’s be clear on the REZI ipo and why the stock saw a decline on ipo day. Unlike A.com and CTRL4 the stock of Resideo was was a spinoff and millions of shares were given to current Honeywell stock holders. Many of those stock holders are large institutional investment firms where they choose to only play in large cap stocks and a home electronics based business does not fit their portfolio. Long story short they sell off the gifted stock on day 1. So let’s be careful when writing articles like this that there is not a jaded author opinion that does not shine light on the full scenario and compares apples to oranges.

Hi, Jamie — I’m the author of that story. Thanks for the comment. While I should definitely have noted this important factor in the story, the stock’s performance in the first couple of days wasn’t a key part of this article. When things settle, it will be interesting to see how the group of 3 (CTRL, REZI, ALRM) performs. Thanks again. I will add your comment to the original story posted on CEPro.com.