U.S. Housing Starts Rally in October Amid Rebound in Multifamily Units

Despite an overall uptick in the housing market, construction of single-family homes declined for a second straight month.

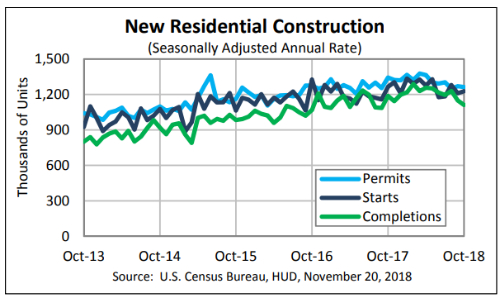

Housing starts increased 1.5 percent to a seasonally adjusted annual rate of 1.23 million units last month.

WASHINGTON — U.S. home construction ticked up 1.5% in October, despite construction of single-family homes falling for a second straight month, according to the latest data from the Commerce Department.

The Commerce Department said Tuesday housing starts rose to a seasonally adjusted annual rate of 1.23 million, up from 1.21 million in September. The gains were attributed entirely to multifamily housing, as starts for single-family houses slipped 1.8% in October.

Attributing factors to recent weakness in the housing market include a labor shortage and a sharp rise in mortgage rates, leading to tight inventories and higher house prices. According to mortgage buyer Freddie Mac, the average 30-year fixed rate mortgage has increased a full percentage point in the past year to 4.94% — the highest average since February 2011.

Among other statistics reported by the Commerce Department, building permits declined in October and homebuilding completions were the fewest in a year. Building permits, which are considered an indicator of future activity, slipped 0.6% to a rate of 1.3 million units in October.

Single-family starts — the largest share of the housing market — dipped 1.8% to a rate of 865,000 units in October after declining in September. Single-family homebuilding has lost momentum since hitting a pace of 948,000 units in November 2017, which was the strongest in more than a decade.

Single-family homebuilding in the South fell 4% in October. Single-family homebuilding jumped 14.8% in the Northeast and dipped 2% in the West. Groundbreaking activity on single-family homes dropped 1.6% in the Midwest.

Permits to build single‐family homes declined .6% in October to a rate of 849,000, compared to the revised September figure of 854,000. Authorizations of units in buildings with five units or more were at a rate of 376,000 in October.

Starts for the multifamily segment rose 10.3% to a rate of 363,000 units in October. Permits for the construction of multifamily homes fell 0.5% to a pace of 414,000 units.

Homebuilder Sentiment Wanes

The Commerce Department’s latest figures followed a report Monday showing a considerable drop in homebuilder sentiment. Affordability concerns contributed to homebuilder confidence declining eight points to 60 in November, according to the National Association of Home Builders/Wells Fargo Housing Market Index.

“Builders report that they continue to see signs of consumer demand for new homes but that customers are taking a pause due to concerns over rising interest rates and home prices,” NAHB Chairman Randy Noel states in an announcement.

The very real prospect of future interest rate hikes has caused builders to adopt a more cautious approach to market conditions, says NAHB Chief Economist Robert Dietz.

“Recent policy statements on economic conditions have lacked commentary on housing, even as housing affordability has hit a 10-year low,” Dietz continues. “Given that housing leads the economy, policymakers need to focus more on residential market conditions.”

If you enjoyed this article and want to receive more valuable industry content like this, click here to sign up for our FREE digital newsletters!

Security Is Our Business, Too

For professionals who recommend, buy and install all types of electronic security equipment, a free subscription to Commercial Integrator + Security Sales & Integration is like having a consultant on call. You’ll find an ideal balance of technology and business coverage, with installation tips and techniques for products and updates on how to add to your bottom line.

A FREE subscription to the top resource for security and integration industry will prove to be invaluable.