Big Idea of the Month: Inside the Selling Process

Go inside the selling process experienced by Doug Wilson, a former Minneapolis alarm dealer who decided it was time to exit the industry.

(Image: sebra/stock.adobe.com)

Some days I feel my life is like a country-western song. Happy and sad. Contemplative and nonthinking. Satisfied and dissatisfied. All could be used to describe aspects of my life. I’m lucky enough to be able to write this column, which I enjoy. I am thrilled about the success of the company I founded, Davis Mergers and Acquisitions Group. My only problem is I don’t always know what happens to our clients after they have sold their company. If that’s true for me, it’s probably true for many of our readers. Hopefully, this column will change that.

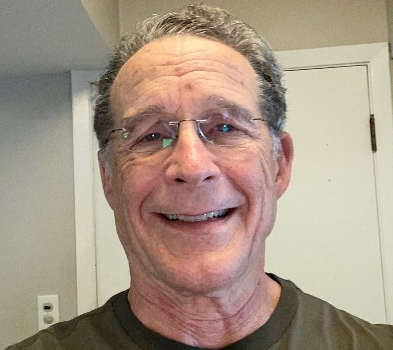

Doug Wilson

Doug Wilson, formerly a Minneapolis alarm dealer with decades of experience, asked us to help him sell his company. Long story short, after a very intensive period of time we got the deal done, and it was closed three or four months ago. From that day on, I hadn’t talked with Wilson (shame on me) until yesterday. I know many dealers suffer seller’s remorse. They are unhappy.

There are other dealers who go on a life adventure that they had been dreaming of for some time. And then there are others, people like Wilson, who are pretty happy, accomplished their goals and are now living the good life — he bought a great vacation home in upper Minnesota and absolutely loves it. And so, with a little bit of trepidation, I asked Wilson if he was happy doing what he did. His reply, “Very happy. I would do the same all over again if I ever started another business, only this time I would pay a lot more attention to some of the things that are important when you go to sell your business.”

The buyer of Wilson’s company was Per Mar Security Services, one of the giants in the industry. We were fortunate enough to be working with the company’s CEO, Brian Duffy. He is truly a good businessman and a really nice guy. We’ve done several transactions together, and I hope to do a lot more in the future. Now, back to Wilson’s story.

His first bit of advice, something very simple, but all too often avoided, was as soon as possible purchase or rent the best financial software you can find. Have it customized for your business, and refer to it repeatedly. And while you’re at it, make sure you review all of the contracts you have used over the years to make sure they are still applicable.

This could cause a real “gotcha” during closing time if you don’t. And then sit down and review all your contracts. Are they current? Do they have the customer signature? Do they have the suggested and required verbiage that all banks request (as well as many buyers). And whatever else you might do, if you’re the seller, stay away from nonindustry brokers. They don’t understand our business.

Not just nonindustry brokers, but also bankers, lawyers and anyone else that is not familiar with what is needed to be a hands-on executive for an alarm company. And since there is no way I could make this article nonpersonal, forgive me if I say that Wilson’s thoughts and mine are pretty much the same.

Wilson went on to say that he had little time for outside interests and would change that if he had to do it all over again. You need to plan ahead for company projects. You need to plan ahead for when you’re going to take vacations. And of course have a goal for what you’re going to do once you’re business is successfully sold.

And finally, Wilson said something I hadn’t really expected. “Now I could write a book on all of the things that happened during the transaction. Fortunately working with the Per Mar team made the whole process a lot easier than it would otherwise have been. I’m sure of that. And finally, whatever it is you do, get a copy of Ron’s book, The Start of the Deal. It will save you a lot of time, because you to have less anxiety about what’s happening, ahead of time, and it will provide a real-life scenario of what happens, really happens, when you go to sell your company.

I’d like to add to Wilson’s points … First, be sure to talk to previous sellers, preferably those who have dealt with the broker you’re using or the accountant you’re using. Do not economize when dealing with lawyers. You need them more than you’ll ever realize, except on the day you sell, and move on. Read all papers and every line of the letter of intent and make sure you understand everything before talking to anyone on your side or, for that matter, anyone on the other side.

And finally, realize that you will know more about your business on the day you sign the purchase agreement than you ever knew before. It amazes everybody when I tell them this, but it’s true. And by the way, if you’d like a complementary copy of the book, just call or write. We’ll get it out to you right away.

Have a great rest of the summer, and Wilson, enjoy the rest of your life. You’ve earned it!

If you enjoyed this article and want to receive more valuable industry content like this, click here to sign up for our FREE digital newsletters!

Security Is Our Business, Too

For professionals who recommend, buy and install all types of electronic security equipment, a free subscription to Commercial Integrator + Security Sales & Integration is like having a consultant on call. You’ll find an ideal balance of technology and business coverage, with installation tips and techniques for products and updates on how to add to your bottom line.

A FREE subscription to the top resource for security and integration industry will prove to be invaluable.