Attrition Report Reveals Security Industry Escaped 2020 Relatively Unscathed

During The Monitoring Association’s Annual Meeting, John Brady shared findings from his yearly attrition report. Industry analysts also dove into recent M&A activity.

Although industry professionals looking forward to traveling to Hawaii for The Monitoring Association’s (TMA) Annual Meeting were disappointed when it was converted into a virtual event, their spirits were rejuvenated by the deftness in which TMA pulled off the online affair — and especially the valuable insights and positive outlook that was shared.

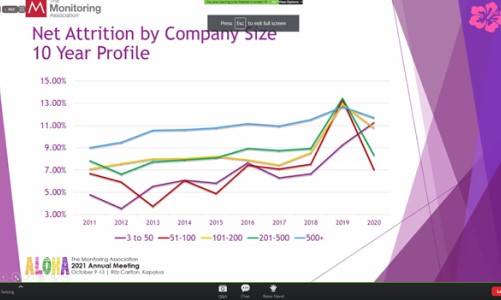

TRG Associates Principal John Brady’s yearly attrition report was high among the good news. His data showed how well the electronic security industry has fared amid the pandemic, with the percentages of lost customer accounts coming in lower across the board (except for small companies). Looking at the causes for attrition, nonpayment, moves and no longer using system dropped; financial difficulties, going out of business and loss to competition rose.

“Security and life safety became of even more paramount importance during the pandemic. All attrition came down as a result. The pandemic showed yet again how well the security industry sustains itself even during the most challenging times, making it attractive to investors,” said Brady.

Speaking of investors, the industry’s best-known analysts — SSI Industry Hall of Famers Les Gold and Michael Barnes, Imperial Capital’s John Mack and Mark Melendes of CIBC Bank USA — were on hand for a mergers & acquisitions session. While installation/monitoring company valuations are down and lending is tighter, according to panelists the marketplace is rebounding.

“Market valuations are stabilizing after a challenging 2020. Financing and lending can still be found,” said Barnes. He added that while the industry is making more money per customer and creation costs are lower, margins are declining. He recommends companies raise prices to keep up with that trend as well as inflation and an anticipated post-pandemic rise in attrition.

While he remains bullish on the smart home market, Mack emphasized the even stronger footing of commercial business. “Lower attrition, lower creation costs, new technology trends and competitive factors means commercial-focused companies are better positioned to achieve higher multiples than residential,” he said.

Melendes offered conclusive sentiment of this session as well as the TMA Annual Meeting overall: “Most security monitoring companies came out of the pandemic stronger and are well positioned for the future. We are coming out of it in a very healthy place.”

Check out the slideshow above for more insights from the presentations.

If you enjoyed this article and want to receive more valuable industry content like this, click here to sign up for our FREE digital newsletters!

Security Is Our Business, Too

For professionals who recommend, buy and install all types of electronic security equipment, a free subscription to Commercial Integrator + Security Sales & Integration is like having a consultant on call. You’ll find an ideal balance of technology and business coverage, with installation tips and techniques for products and updates on how to add to your bottom line.

A FREE subscription to the top resource for security and integration industry will prove to be invaluable.