Beware New 2018 Tax Act Meal and Entertainment Deduction Rules

Not only do new 2018 tax act rules increase the net cost of the travel to an employer, it creates new procedures for bookkeeping and accounting personnel.

The biggest shock to many taxpayers is going to be that expenses for entertaining clients — expenses that used to be 50% deductible — may no longer be deductible, at all.

While the media has given extensive coverage to many of the changes in the 2018 tax act as they relate to individuals and large corporations, some big changes in the ability of small businesses and individual workers to expense meals and entertainment seem to have gone unnoticed.

As we prepare for ISC West 2018 in Las Vegas, you may want to be aware that the saying, “What happens in Vegas, stays in Vegas,” may also apply to your tax deductions.

The biggest shock to many taxpayers is going to be that expenses for entertaining clients — expenses that used to be 50% deductible — may no longer be deductible, at all. Under previous tax law, the face value of event tickets (sporting events, Las Vegas shows, etc.) was deductible (premiums paid to scalpers were not).

Under the new tax bill, event tickets are also no longer deductible — at all. Go ahead and take your client to the Cirque de Solei show; just don’t expect to deduct the price of the tickets, dinner and drinks, on your 2018 corporate or personal tax return.

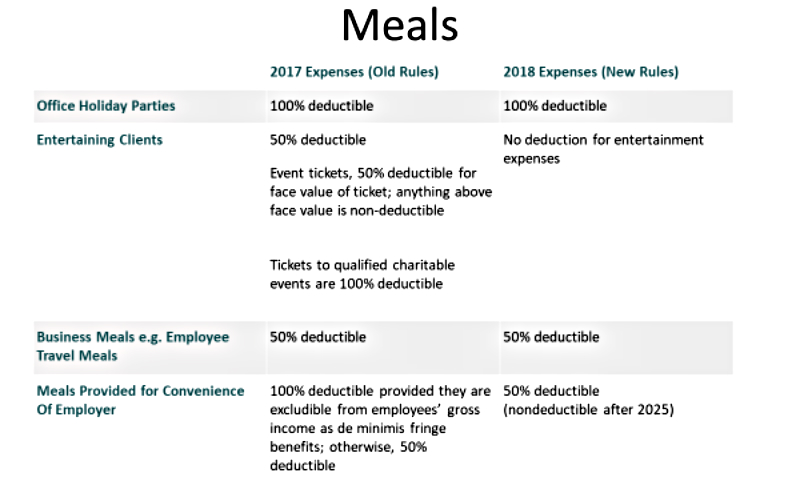

The table below is a summary of the deductibility of certain expenses under the old and new rules:

The “three martini lunch” has been a hot target for the IRS and Congress for decades. The old rules addressed the topic somewhat by limiting entertainment deductions to 50%. In another example of how the development of tax code is like a visit to the sausage factory, Congress, for numerous reasons, has gone after an abused tax provision and taken away a deduction, and erred on the side of keeping the entire classroom in over recess because a few kids were acting up.

The most unfair provision is the limitation of the deductibility of “Meals Provided for Convenience of Employer.”

Many of my clients have installation crews working in a remote location that requires them to spend the night. Under the previous tax code their room at the local Holiday Inn, and their meals at Denny’s were completely deductible. This made sense because these deductions were rarely lavish and truly were for the “convenience of the employer.”

Under the new code, the room at the Holiday Inn is still deductible but the patty melt at Denny’s is only 50% deductible. Not only does this increase the net cost of the travel to an employer, it creates new procedures for bookkeeping and accounting personnel.

Have fun in Vegas, but remember that $27 burger at Wofgang Puck’s isn’t going to be on Uncle Sam.

If you enjoyed this article and want to receive more valuable industry content like this, click here to sign up for our FREE digital newsletters!

Security Is Our Business, Too

For professionals who recommend, buy and install all types of electronic security equipment, a free subscription to Commercial Integrator + Security Sales & Integration is like having a consultant on call. You’ll find an ideal balance of technology and business coverage, with installation tips and techniques for products and updates on how to add to your bottom line.

A FREE subscription to the top resource for security and integration industry will prove to be invaluable.